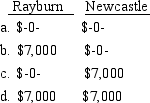

Rayburn owns all the shares of Newcastle Corporation that operates as an S corporation. Rayburn's basis in the stock is $15,000. During the year he receives a cash distribution of $22,000 from Newcastle. What must Rayburn and Newcastle report as income from the cash distribution?

Definitions:

Capital Investment

Funds spent by a firm to acquire or upgrade physical assets such as property, industrial buildings, or equipment to increase its value or productivity.

Soil Reclamation

The process of improving damaged soil to restore its productive capacity, often involving the removal of pollutants or the addition of soil amendments.

Water Shed Reclamation

The process of recovering, treating, and reusing water from a watershed area for beneficial purposes, often related to environmental management.

Generally Accepted Accounting Principles

A collection of commonly-followed accounting rules and standards for financial reporting.

Q5: The final step in the tax research

Q7: The deferral of a gain realized on

Q31: A rocket club makes its own rockets.

Q33: Al and Joe are two county

Q36: A 95% confidence interval for the mean

Q40: Nicole has the following transactions related to

Q48: If the U.S. Supreme Court denies a

Q50: Harry sells an apartment building for $117,000.

Q85: A flood destroys Franklin's manufacturing facility. The

Q118: Assets eligible for preferential treatment under Section