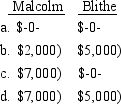

Malcolm receives a liquidating distribution of land with a fair market value of $14,000 and a basis of $19,000 from Blithe Corporation, an S corporation. Malcolm's basis in the stock is $21,000. What must Malcolm and Blithe report as income loss) from the property distribution?

Definitions:

Practice New Skill

The process of actively working on acquiring or improving a specific ability or competency through repetition and training.

Blood Glucose

A measure of the sugar level in the blood at a given time, important for managing diabetes and assessing metabolic health.

MyPlate

A visual guide created by the U.S. Department of Agriculture to help Americans understand and follow healthy eating patterns, representing recommended proportions of food groups.

Group Facilitator

An individual who guides and manages the process and interaction of a group to achieve effective communication and reach desired outcomes.

Q20: The grocery expenses for six families were

Q20: The maximum contribution that can be made

Q21: The t distribution can be used when

Q42: Cathy owns property subject to a mortgage

Q58: Reiko buys 200 shares of Saratoga Corporation

Q59: Stan sells a piece of land he

Q67: Martina, an unmarried individual with no dependents,

Q75: Karl is scheduled to receive an annuity

Q84: Explain why a taxpayer would ever consider

Q90: Brock exchanges property with an adjusted basis