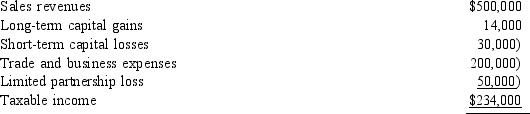

Cornell and Joe are equal partners in Jones Company. For the current year, Jones reports the following items of income and expense:  In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

Definitions:

Q9: Sorensen Corporation purchases equipment in 2014 for

Q10: Section 1245 property is subject to a

Q14: John purchases all of the common stock

Q22: Tory sells General Electric stock owned 10

Q27: A two-tailed test is conducted at the

Q62: On March 11, 2012, Carlson Corporation granted

Q63: Which of the following businesses must use

Q70: Corky receives a gift of property from

Q75: Karl is scheduled to receive an annuity

Q99: Mike purchases a computer 5-year property) for