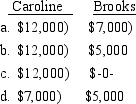

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation. Caroline's basis in the stock is $32,000. What must Caroline and Brooks report as income loss) upon the liquidation of Brooks?

Definitions:

Basal Metabolism

The rate at which the body uses energy while at rest to maintain vital functions such as breathing and keeping warm; the minimum amount of energy consumed in a resting state.

Nonparametric Methods

Statistical techniques that do not assume a specific distribution for the data, often used when data do not meet the assumptions of parametric tests.

Wilcoxon Rank Sum Procedure

A nonparametric test used to compare two independent samples to determine if they come from the same distribution.

Wilcoxon Rank Sum Test

A nonparametric test that compares two independent samples to determine if they come from the same distribution.

Q5: The final step in the tax research

Q10: The Section 179 election promotes which of

Q10: A two-tailed test is conducted at the

Q16: Drake and Cynthia sell their home for

Q22: Tory sells General Electric stock owned 10

Q23: Manu bought Franklin's ownership interest in Antoine

Q23: Which of the following qualify as replacement

Q25: A researcher wishes to estimate the mean

Q58: Rosilyn trades her old business-use car with

Q77: When the Supreme Court grants a writ