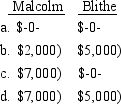

Malcolm receives a liquidating distribution of land with a fair market value of $14,000 and a basis of $19,000 from Blithe Corporation, an S corporation. Malcolm's basis in the stock is $21,000. What must Malcolm and Blithe report as income loss) from the property distribution?

Definitions:

Temporal Summation

The process by which multiple sub-threshold signals can combine over time at a synapse to produce a significant effect, often leading to action potential if the threshold is reached.

Nobel Prize

Prestigious international awards given annually in several categories including physics, chemistry, medicine, literature, peace, and economic sciences, to those who confer the greatest benefit to humanity.

John C. Eccles

A neurophysiologist who won the Nobel Prize in Physiology or Medicine for his work on the synapse and neurotransmitters.

Squid Axons

Squid axons are large nerve fibers used in research to understand the fundamental properties of nerve impulse conduction.

Q7: The deferral of a gain realized on

Q18: Which of the following qualifies as a

Q18: During 2014, Duncan Company purchases and places

Q28: Sample size = 400, sample mean =

Q35: In a random sample of 400 jelly

Q37: Carolyn purchases a new delivery truck 5-year

Q55: The test scores of 32 students

Q56: In the past, the mean running

Q64: Dwight, a single taxpayer, has taxable income

Q106: Raymond, a single taxpayer, has taxable income