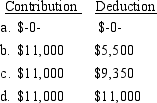

Cisco and Carmen are both in their 30's and are married. Carmen earns $69,000 and Cisco earns $28,000. Their adjusted gross income is $102,000. Carmen is an active participant in her company's pension plan. Cisco's employer does not have a pension plan. What are Carmen and Cisco's maximum combined IRA contribution and deduction amounts?

Definitions:

Federal Funds

Financial resources provided by the federal government to states, localities, and institutions, often for specific projects or purposes.

Exceptionalities

Unique differences or needs in individuals, especially those relating to cognitive, physical, psychological, or educational characteristics.

Cultural Group

A community of people who share common languages, traditions, customs, values, and often geographic locations.

Inclusion

Children with disabilities educated in a general education classroom setting as much as the disability will allow.

Q10: Suppose you pay $1.00 to roll a

Q10: The number of vehicles passing through

Q12: All judicial citations follow the same format:

Q13: What body oversees the operation and administration

Q20: Stanford-Binet IQ scores have a population mean

Q30: Title 26 of the U.S. Code includes<br>A)

Q43: The advertising for a cold remedy claimed

Q51: Which income tax concepts/constructs might taxpayers who

Q59: Suppose that you pay $2 to roll

Q98: Contrast the facts and circumstances depreciation approach