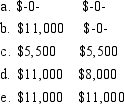

Kathy and Patrick are married with salaries of $28,000 and $21,000, respectively. Adjusted gross income on their jointly filed tax return is $54,000. Both individuals are active participants in employer provided qualified pension plans. What are Kathy and Patrick's maximum combined IRA contribution and deduction amounts? Contribution Deduction

Definitions:

Allocated Efficiently

Refers to the optimal distribution of resources and goods in a way that maximizes the welfare or utility of consumers.

External Costs

Expenses that a business or economic activity imposes on unrelated third parties or the environment, which are not reflected in market prices.

External Benefits

External Benefits are positive effects of a production or consumption activity on third parties who did not directly participate in the economic transaction.

Living in Poverty

The condition of having insufficient resources or income to meet basic life needs.

Q1: Carlota owns 4% of Express Corporation and

Q14: Sonya is an employee of Gardner Technology

Q21: A nurse measured the blood pressure of

Q24: A limitation exists on the annual amount

Q26: There are over 1200 species of inchworms

Q29: Find the standard deviation for the given

Q35: Winston is the sole shareholder of Winston

Q74: A taxable entity has the following capital

Q87: On February 19, 2012, Woodbridge Corporation granted

Q118: Assets eligible for preferential treatment under Section