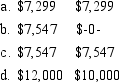

Jim, age 71, is a single taxpayer who retired from his job at the Lansing Corporation in 2013. On January 1, 2014, when he begins to receive his annuity distribution, the value of his pension plan assets is $200,000 and his basis is zero. What amount must Jim receive in 2014 and how much of the amount he receives is taxable? Required Amount Distribution Taxable

Definitions:

Impaired Skin Integrity

A condition where the skin, which normally acts as a protective barrier, is damaged or compromised.

Nursing Assistive Personnel

Individuals who provide basic patient care under the supervision of nursing and medical staff, often including tasks like bathing, feeding, and monitoring vital signs.

Evaluation Phase

The stage in a process where the outcomes are analyzed to determine if the goals were achieved and to identify any areas for improvement.

Nursing Diagnosis

A clinical judgment about individual, family, or community responses to actual or potential health problems/life processes.

Q7: Which of the following entities directly bear

Q11: In 1990, the average duration of

Q14: During a year when there was

Q15: The lifetimes of light bulbs of a

Q19: The most important source of current federal

Q41: Find the mode(s) for the given sample

Q43: Hammond Inc., sells a building that it

Q51: On May 10, 2012, Rafter Corporation granted

Q52: Which of the distributions has the greatest

Q91: Unrecaptured Section 1250 gain I. is taxed