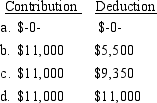

Cisco and Carmen are both in their 30's and are married. Carmen earns $69,000 and Cisco earns $28,000. Their adjusted gross income is $102,000. Carmen is an active participant in her company's pension plan. Cisco's employer does not have a pension plan. What are Carmen and Cisco's maximum combined IRA contribution and deduction amounts?

Definitions:

Cryptocurrency

A digital or virtual currency that uses cryptography for secure financial transactions, and operates independently of a central bank.

Public Ledger

A ledger available to the public that records all transactions in a network, commonly associated with blockchain technology.

Codec

A device or program that compresses data to enable faster transmission and decompresses received data.

MPEG-4

A method of defining compression of audio and visual (AV) digital data, introduced to provide improved multimedia capabilities.

Q5: Chase, Marty and Barry form a partnership.

Q7: During the current year, Timepiece Corporation has

Q18: In a national poll, 1036 people were

Q28: Dunn Company bought an old building in

Q33: The table lists the winners of

Q35: A gain on a like-kind exchange is

Q42: Zeppo and Harpo are equal owners of

Q42: The test scores of 40 students

Q67: Based on meteorological records, the probability that

Q74: Rosilyn trades her old business-use car with