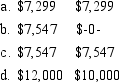

Jim, age 71, is a single taxpayer who retired from his job at the Lansing Corporation in 2013. On January 1, 2014, when he begins to receive his annuity distribution, the value of his pension plan assets is $200,000 and his basis is zero. What amount must Jim receive in 2014 and how much of the amount he receives is taxable? Required Amount Distribution Taxable

Definitions:

Replacement Planning

A strategic process for identifying and developing successors for key positions within an organization to ensure continuity.

Succession Management

The method of finding and grooming new leaders to take over when existing leaders depart, retire, or die, thereby maintaining the continuous operation of the organization.

Effectiveness Perceptions

Individuals' or groups' beliefs about the degree to which a process, action, or policy achieves its intended outcome.

Key Characteristics

The most important attributes or qualities that define an object, person, or organization.

Q3: Tony and Faith sell their home for

Q6: A researcher claims that the amounts of

Q10: The holding period of an asset received

Q15: <span class="ql-formula" data-value="\mathrm { z } =

Q34: Which line chart below represents the

Q37: Thomas maintains an IRA account. During the

Q42: The test scores of 40 students

Q50: On January 5, 2014, Mike acquires a

Q62: The IRS may acquiesce or nonacquiesce to

Q82: Which of the following best describes the