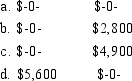

Helen receives the right to acquire 700 shares of Smith Corporation stock through the company's incentive stock option plan. The fair market value of the stock at the date of the grant is $8 and the exercise price of the option is $15 per share. The fair market value of the stock at the date of exercise is $19. Helen will recognize income at the date of grant and the exercise date of Date of grant Exercise date

Definitions:

Attitudes

This term encompasses the various predispositions or outlooks an individual holds towards different objects, people, or situations, shaped by experience and influencing behavior.

Beliefs

Convictions or acceptances that something exists or is true, especially without proof.

Feelings

Emotional states or reactions that are subjective and experienced internally by individuals.

Personal Control

The power people perceive they have over their destinies.

Q9: Mountainview Corporation sells depreciable residential real estate

Q26: Withdrawals of cash by a partner are

Q30: The lifetimes of projector bulbs of a

Q37: Primary sources of tax law include I.

Q48: If the U.S. Supreme Court denies a

Q51: A long-distance telephone company claims that the

Q52: A cereal company claims that the mean

Q81: Taxpayers are allowed to structure transactions through

Q113: Benson Company purchased a drill press on

Q114: Santana purchased 200 shares of Neffer, Inc.