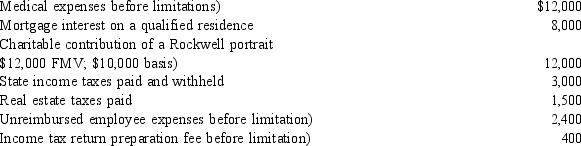

Eileen is a single individual with no dependents. Her adjusted gross income for 2014 is $60,000. She has the following items that qualify as itemized deductions. What is the amount of Eileen's AMT adjustment for itemized deductions for 2014?

Definitions:

Q4: Nestor receives the right to acquire 1,000

Q16: Find the original data from the

Q19: The most important source of current federal

Q23: The time series line chart below shows

Q33: <span class="ql-formula" data-value=" \mathrm{H}_{\mathrm{a}}: \mu>21.1, \bar{x}=21.5, \sigma=6,

Q38: In a poll of 400 voters in

Q63: Find the standard deviation for the given

Q65: Which of the following businesses can use

Q67: In 2009, Merlin received the right to

Q81: Taxpayers are allowed to structure transactions through