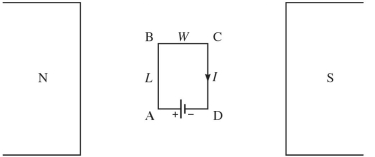

A flat rectangular loop of wire is placed between the poles of a magnet, as shown in the figure. It has dimensions and , and carries a current in the direction shown. The magnetic field due to the magnet is uniform and of magnitude . The loop rotates in the magnetic field and at one point the plane of the loop makes a angle with the field. At that instant, what is the magnitude of the torque acting on the wire due to the magnetic field?

Definitions:

Times Interest Earned

A ratio that assesses the risk that bondholders will not receive their interest payments or that interest payments will not be made if earnings decrease. The ratio is computed as income before income tax expense plus interest expense divided by interest expense.

Interest Expense

The cost incurred by an entity for borrowed funds, often reflected as a line item on the income statement.

Days' Sales

A financial metric that estimates the average time it takes for a company to convert its inventory into sales.

Inventory

The total amount of goods and materials held by a business for the purpose of sale or production.

Q44: A radio station broadcasts at

Q82: A simple ac circuit consists of an

Q84: A siren emitting sound of frequency 1000

Q110: Which of the following will increase the

Q143: A pipe of length L that is

Q229: To determine the height of a flagpole,

Q310: The primary coil of an ideal transformer

Q451: Abby throws a ball straight up and

Q521: Which one of the following quantities is

Q526: One of the harmonics of a column