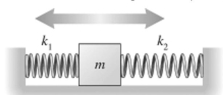

A 2.0-kg block on a frictionless table is connected to two springs whose opposite ends are fixed to walls, as shown in the figure. The springs have force constants (spring constants)  What is the oscillation angular frequency of the block if

What is the oscillation angular frequency of the block if

Definitions:

Risk-averse

A preference for certainty over gamble, where an individual prefers to avoid risk even if it means a potentially lower expected return.

Political Science Major

An academic discipline that focuses on the study of government, political processes, and political behavior.

English Major

An academic field of study that focuses on literature, language, and writing in the English language.

Expected Utility

Sum of the utilities associated with all possible outcomes, weighted by the probability that each outcome will occur.

Q41: A point charge of <span

Q52: A researcher wishes to determine whether listening

Q68: The process shown on the

Q71: The cylindrical filament in a light

Q73: A heat engine absorbs 64 kcal of

Q76: A 5.00-g lead BB moving at

Q77: A quantity of an ideal gas

Q81: As shown in the figure, water

Q84: The position of an object that is

Q88: In grinding a steel knife, the