Match the function with its graph.

-1)

2)

3)

4)

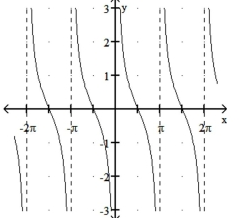

a)

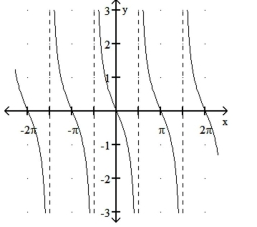

b)

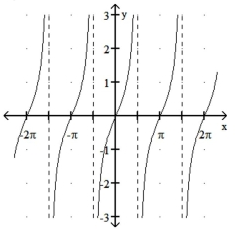

c)

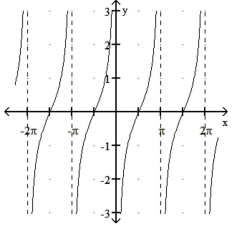

d)

Definitions:

Spot Rate

The price at which a financial instrument or commodity can be bought or sold for immediate delivery, emphasizing current market value.

Fair Value Hedge

A hedge that protects against changes in the fair value of assets, liabilities, or unrecognized firm commitments.

Fair Value Hedge

A hedge that is used to mitigate the risk of changes in the fair value of an asset or liability or an unrecognized firm commitment.

Cash Flow Hedge

A financial strategy used to manage the risk of fluctuations in cash flow due to changes in exchange rates, interest rates, or commodity prices.

Q18: tan 23° < tan 4°

Q34: Suppose the tip of the minute

Q35: <span class="ql-formula" data-value="\sin 2 \theta = -

Q79: A circular sector has an area

Q99: A circular pulley is rotating about

Q115: cos (-283°)and sin (-283°)<br>A)negative and positive<br>B)positive and

Q128: A wooden block sitting at rest

Q139: <span class="ql-formula" data-value="\tan \frac { 5 \pi

Q152: Let angle POQ be designated ϴ.

Q181: <span class="ql-formula" data-value="\frac { 1 - \cot