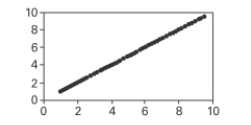

Based on the scatterplot, select the most likely value of the linear correlation coefficient r.

Definitions:

Federal Withholding Taxes

Income taxes automatically deducted from an employee's paycheck by the employer, sent to the government as partial payment of the yearly tax obligation.

Unemployment Taxes

Taxes paid by employers to fund unemployment insurance programs, providing benefits to workers who have lost their jobs.

Supplemental Wage Payments

Additional wages paid to an employee, varying from regular salary, such as bonuses, commission, overtime pay, and severance pay, which may be taxed differently.

Accountable Plan

This is an IRS-recognized plan that allows businesses to reimburse employees for work-related expenses tax-free, provided certain conditions are met, such as business connection and adequate accounting.

Q4: Perform the indicated goodness-of-fit test. You

Q6: Explain how our understanding of the three

Q10: What are the pros and cons of

Q20: A rank correlation coefficient is to be

Q24: A die is rolled nine times and

Q39: Assume that the two samples are

Q54: Describe what scatterplots are and discuss the

Q58: An oil change shop claims that

Q71: A run chart for individual values is

Q111: _ It's best to take notes for