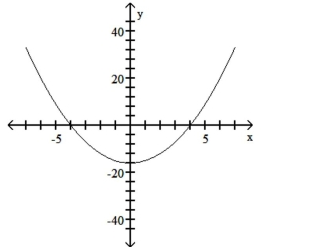

Use the given graph to find the x-intercepts and zeros of the function.

-

Definitions:

Internal Integration

The process of ensuring that different departments and functional areas within an organization work together effectively towards common goals.

Group and Team Boundaries

The defined limits and roles within a group or team that differentiate members from non-members and establish the scope of their collective work.

External Adaptation

The adjustment process entities undergo to cope with new, changed, or evolving outside environmental factors.

Internal Integration

The process of ensuring various elements within an organization work together effectively and harmoniously.

Q6: <span class="ql-formula" data-value="20 C _ { 4

Q9: {(-3,9), (-1,4), (2,-6), (6,-9)}<br>A) Yes<br>B) No

Q21: <span class="ql-formula" data-value="- \sqrt { - 4

Q27: <span class="ql-formula" data-value="( - 8 + 4

Q45: How can the graph of

Q48: <span class="ql-formula" data-value="f ( x ) =

Q50: <span class="ql-formula" data-value="\text { Let } A

Q63: A set of 11 elements<br>A)2048<br>B)22<br>C)1024<br>D)23

Q68: <span class="ql-formula" data-value="h ( x ) =

Q183: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) x-intercept: (3,