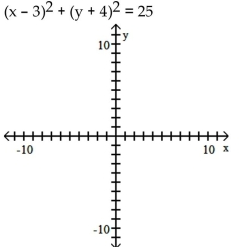

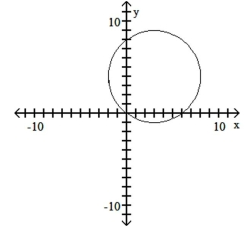

Graph the circle using the given equation.

-

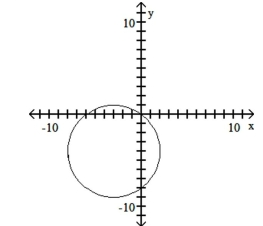

A)

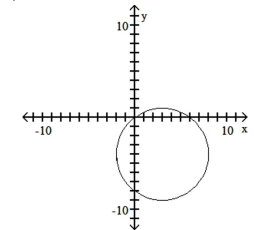

B)

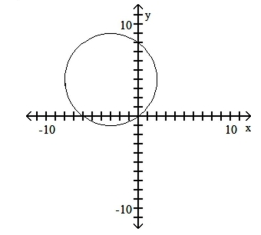

C)

D)

Definitions:

Formal Responsibility

The obligation to perform tasks or duties as defined by one's role or position within an organization, often governed by official rules and procedures.

Self-Managing Teams

Groups of workers who are given autonomy to plan and execute their tasks, often without direct supervision, fostering collaboration and shared responsibility.

Day-To-Day Basis

Refers to the daily, routine occurrences or operations, emphasizing regular or frequent activity.

Informal Teams

Groups that form naturally within the workplace, based on personal relationships rather than structured by the organization.

Q4: What are the main differences between the

Q5: You find that the Black-Derman-Toy model predicts

Q9: Determine the swap rate for the following

Q17: Mr. Brown wants to invest $100,000 for

Q25: <span class="ql-formula" data-value="f ( x ) =

Q28: <span class="ql-formula" data-value="f ( x ) =

Q30: <span class="ql-formula" data-value="| 4 x | <

Q88: <span class="ql-formula" data-value="f ( x ) =

Q132: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" Find (f/g)(x) A)

Q144: y - 11 < -16 <br><img