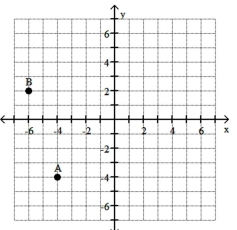

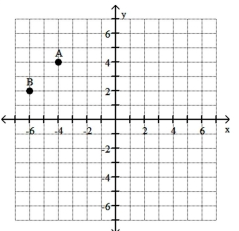

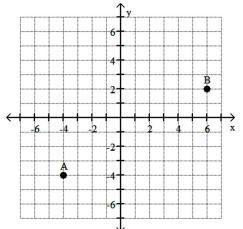

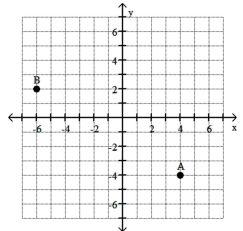

Plot the two points given by the ordered pairs.

-A(-4, -4), B(-6, 2)

A)

B)

C)

D)

Definitions:

Statutory Tax Rates

The tax rate legally imposed on income or profits by the government, which can vary depending on the type of income, entity, or other factors.

Deferred Income Tax Liability

A tax obligation recorded on the balance sheet that refers to taxes that are due in the future due to temporary differences between the financial accounting and tax reporting.

Pre-Tax Book Income

The income of a company before taxes have been deducted, as recorded in the accounting records according to standard accounting practices.

Tax Depreciation

The depreciation expense allowed by taxation authorities that enables a taxpayer to recover the cost of property or assets.

Q5: The term structure of interest rates can

Q13: If short term rates go up, what

Q20: A rectangular box with volume 468 cubic

Q50: <span class="ql-formula" data-value="| 5 x + 5

Q70: f(x)= -x2 + 10x + 24<br>A)Increasing on

Q76: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A)

Q82: The position of an object moving

Q90: 3; <span class="ql-formula" data-value="f (

Q123: <span class="ql-formula" data-value="f ( x ) =

Q182: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) 2 B)