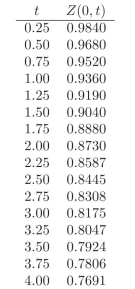

Use the following discount factors when needed.

-Calculate the duration of the following portfolio:

i. 5 units of a 2-year ?xed rate bond paying 6% quarterly.

ii. 2 units of a 1.75-year ?oating rate bond paying ?oat + 80 bps semi- annually. You know that the reference rate was 6.5% three months ago.

iii. 6 units of a 1-year zero coupon bond.

iv. 5 units of a 1.5-year ?oating rate bond with no spread paid semian- nually.

Definitions:

Fundamental Attribution

The tendency to overemphasize personality traits and underestimate situational factors when explaining others' behavior.

Reciprocity

A mutual exchange of privileges, benefits, or actions between people, where one's action leads to a response of a similar kind.

Social Loafing

The occurrence in which people put in less effort to reach an objective while working as part of a team compared to when they are working individually.

Conformity

The adjustment of one's behavior or beliefs to match those of others, typically in response to real or imagined social pressure.

Q5: How is spot rate duration defined in

Q8: How can the graph of

Q16: How strong is the correlation among rates

Q39: Time and material pricing is used widely

Q98: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) y -axis

Q107: <span class="ql-formula" data-value="8 - | 4 x

Q125: g(x)= -f(x)- 3 <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt="g(x)= -f(x)-

Q129: Elissa sells two breeds of dogs, Alaskan

Q151: <span class="ql-formula" data-value="f ( x ) =

Q154: At Allied Electronics, production has begun