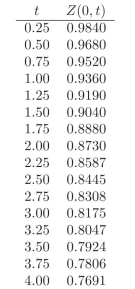

Use the following discount factors when needed.

-Calculate the duration of the following security: 5-year zero coupon bond.

Definitions:

Marginal Tax Rate

The tax rate that applies to the last dollar of the taxpayer's income, indicating the percentage of tax paid on any additional income earned.

Taxable Income

The portion of an individual or entity's income used as the basis to calculate how much the individual or entity owes in taxes.

Average Tax Rate

The proportion of total taxable income that individuals or corporations pay in taxes, calculated by dividing the total tax amount by the total income.

Taxable Income

Income subject to tax by federal, state, or local tax authorities.

Q4: The payback method is a popular way

Q7: What is a log-normal model? When are

Q18: If you use caps and bonds to

Q18: How does seasonality affect the prepayment option?

Q60: <span class="ql-formula" data-value="f ( x ) =

Q86: In a net-present-value analysis, the discount rate

Q96: Durango Industries employs cost-plus pricing formulas to

Q100: A salesperson has two job offers. Company

Q127: <span class="ql-formula" data-value="\sqrt { 3 x +

Q152: <span class="ql-formula" data-value="f ( x ) =