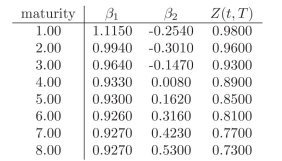

You currently hold a 7-year fixed rate bond paying 1% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 2-year zero coupon bond and a 6-year zero coupon bond as hedging instruments. Use the following table to compute the adequate positions in the hedging instruments.

Definitions:

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A)

Q11: What is the PV01 of the following

Q44: <span class="ql-formula" data-value="h ( x ) =

Q66: <span class="ql-formula" data-value="- 5 x + 10

Q72: <span class="ql-formula" data-value="f ( x ) =

Q75: Flagler Electronics currently sells a camera for

Q80: <span class="ql-formula" data-value="f ( x ) =

Q96: <span class="ql-formula" data-value="f(x)=4 x^{2}-3 x-8"><span class="katex"><span class="katex-mathml"><math

Q125: 6x+2 y=8<br>18 x+6 y=28<br>A) Parallel<br>B) Perpendicular<br>C) Neither

Q142: The points <span class="ql-formula" data-value="(