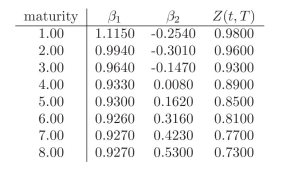

You currently hold a 2-year fixed rate bond paying 1% annually. You would like to hedge against changes in the level and the slope of the yield curve and you plan to use a 1-year zero coupon bond and a 8-year zero coupon bond as hedging instruments. Use the following table to compute the adequate positions in the hedging instruments.

Definitions:

Compound Name

A designation or set of names used to identify a chemical compound based on its structure or molecular components.

Compound

A mixture formed by chemically joining two or more elements.

N,N-Diethylbutanamide

An organic compound featuring a butanamide core where both hydrogens of the amide group are replaced with ethyl groups.

IUPAC Systematic Name

A standardized naming system for chemicals formulated by the International Union of Pure and Applied Chemistry (IUPAC) that provides a unique way to identify a chemical substance.

Q10: Today you notice that forward rates are

Q19: What effect does inflation have on discount

Q30: Penetration pricing is a pricing strategy in

Q36: (4, 5); 5x + 3y = 35<br>A)Yes<br>B)No

Q54: What price must Longwood charge if the

Q58: Activity-based-costing systems are costly, time-consuming to implement,

Q64: Which of the following represents the cost-plus

Q73: A cash flow measured in real dollars:<br>A)

Q93: Passes through (-5,-9) and

Q94: y = 2f(x) <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2705/.jpg" alt="y =