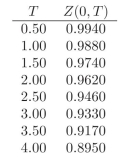

You are given the following discount factors:  You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

You are told that the price of a European Call option on a 6-month zero coupon bond, with T =0.5andK =99.35 is 0.13. While the price of a European Put option with the exact same specification is: 0.11. Are the securities adequately priced?

Definitions:

Efficient Markets Hypothesis

A financial theory stating that asset prices fully reflect all available information, making it impossible to consistently achieve higher returns than the overall market.

Financial Risk

The possibility of losing money on an investment or business venture due to various factors including market fluctuations, interest rate changes, and credit risk.

Efficient Market Theory

A hypothesis stating that financial markets fully incorporate all available information into asset prices at all times.

Interest Rate

The annual percentage rate applied to the outstanding amount of a loan, representing the charge borrowers pay for interest.

Q17: What steps would you follow in order

Q21: A rectangle that is x feet wide

Q23: Krate Inc. is considering a $600,000 investment

Q31: <span class="ql-formula" data-value="\sqrt { x + 6

Q42: Domain: All students attending the University of

Q45: How can the graph of

Q80: Charlene Company, which desires to enter the

Q114: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A) y-axis B)

Q118: A cash flow measured in nominal dollars

Q173: A study was conducted to compare