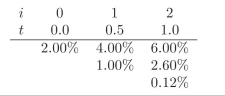

You are given the following interest rate tree. Use it when required in the

exercises.

-Using risk neutral pricing obtain the value for a put option on a 1.5 year zero coupon bond with K = 97.40, maturity at t = 1. Assume that p? = 0.7038 is constant over time.

Definitions:

Orphaned

In a business context, refers to accounts, clients, or projects that no longer have a specific person or team assigned to manage them.

Sales Representative

A person employed by a company to sell its products or services to customers, often responsible for managing customer relationships and achieving sales targets.

Television Station

A service provider or facility that delivers television programming through over-the-air broadcasts to viewers in a specific geographic area.

Orphaned Customers

Customers who lose their representative or point of contact in a company and may feel neglected or underserved.

Q4: Calculate the convexity of the following security:

Q11: What is the price on a 5.75-year

Q13: Consider the following statements about taxes and

Q15: Compute F (0, 3, 5), f2(0, 3,

Q16: A company's hurdle rate is generally influenced

Q17: What happens to the value of an

Q20: The term "opportunity cost" is best defined

Q43: Consider the following factors related to an

Q62: The following data pertain to Arctic Company's

Q72: When activity-based costing is integrated with target