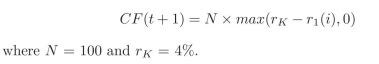

Assume that after you estimate the risk neutral model for the continously compounded rate you arrive at the tree presented at the beginning of this chapter. There is equal probability of moving up or down on the tree. Price a 2-year cap that pays at time t + 1 the following cash ?ow:

Definitions:

Depth of Field

In photography, the range within a photo that appears sharp and in focus, with the area in front of and behind the subject appearing more blurred.

Total Magnification

The overall enlargement of the viewed image in microscopy, calculated by multiplying the magnification of the ocular lens by that of the objective lens.

Field of View

The extent of the observable world seen at any given moment from a particular position and viewpoint.

Ocular Lens

The lens within the eye that focuses light on the retina, enabling clear vision by adjusting its shape.

Q7: Value a 1.5 year swap, with swap

Q9: What is the TBA market?

Q11: Are forward interest rates equal to the

Q15: What does securitization mean?

Q17: When pricing options under the Hull-White, what

Q38: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB34225555/.jpg" alt=" A)

Q50: <span class="ql-formula" data-value="f ( x ) =

Q68: y varies directly as x and

Q83: Linear programming is used for writing code,

Q104: The internal rate of return equates the