Multiple Choice

A new machine is expected to produce a MACRS deduction in three years of $50,000.

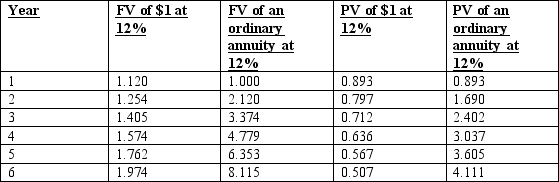

If the company has a 12% after-tax hurdle rate and is subject to a 30% income tax rate, the correct discounted net cash flow to include in an acquisition analysis would be:

Definitions:

Related Questions

Q3: Using Monte Carlo Simulations, what steps do

Q8: What are the two important differences in

Q11: What steps do we follow for a

Q14: What problem does the Cox-Ingersol-Ross (CIR) model

Q15: What is a range floater?

Q22: If Overton uses variable costs as

Q44: The true economic yield produced by an

Q48: On a graph where the horizontal axis

Q66: Clear Skies Airline Company is planning a

Q108: When income taxes are considered in capital