In 10 years, Hopkins Company plans to receive $9,000 cash from the sale of a machine that has a $5,000 book value.

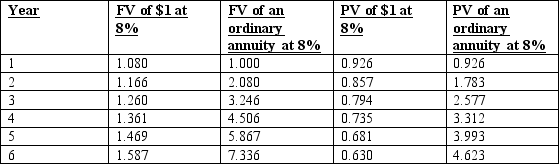

If the firm is subject to a 30% income tax rate and has an 8% after-tax hurdle rate, the correct discounted net cash flow would be:

Definitions:

Restrictive Covenants

Clauses in a contract that place limitations on the actions of parties involved, often used in real estate and employment agreements.

Q2: The managerial accountant's primary role in the

Q8: What is the dollar duration of the

Q8: Admac's variable-overhead efficiency variance is:<br>A) $20,000 favorable.<br>B)

Q10: What is a solution to a PDE?

Q11: Flavor Enterprises has been approached about providing

Q13: What do we need to build in

Q15: Consider the following statements about the investment

Q63: Startup, Inc. provides a variety of telecommunications

Q65: A special order generally should be accepted

Q70: Inse Corporation uses time and material pricing.