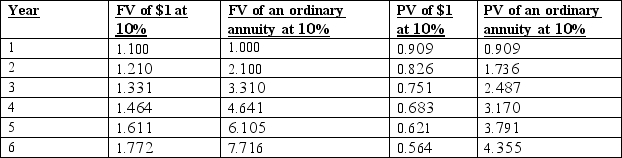

The Excon Machine Tool Company is considering the addition of a computerized lathe to its equipment inventory. The initial cost of the equipment is $600,000, and the lathe is expected to have a useful life of five years and no salvage value. The cost savings and increased capacity attributable to the machine are estimated to generate increases in the firm's annual cash inflows (before considering depreciation) of $180,000. The machine will be depreciated using MACRS for tax purposes. The 5-year MACRS depreciation percentages as computed by the IRS are: Year 1 = 20.00%; Year 2 = 32.00%; Year 3 = 19.20%; Year 4 = 11.52%; Year 5 = 11.52%; Year 6 = 5.76%.

Warren is currently in the 40% income tax bracket. A 10% after-tax rate of return is desired.

Required:

A. What is the net present value of the investment? Round to the nearest dollar.

B. Should the machine be acquired by the firm?

C. Assume that the equipment will be sold at the end of its useful life for $100,000. If the depreciation amounts are not revised, calculate the dollar impact of this change on the total net present value.

Definitions:

Descent with Modification

A core principle of evolutionary biology indicating that species change over time, giving rise to new species, while sharing a common ancestor.

Darwin's Idea

Refers to the theory of evolution by natural selection, proposed by Charles Darwin, which describes how species evolve over time through changes in heritable traits.

Shared Similarities

Characteristics or traits that are common across different entities, indicating a degree of relatedness or evolutionary history.

Georges Cuvier

A French naturalist and zoologist known for establishing extinction as a fact and founding the field of comparative anatomy.

Q7: Explain the intuition behind the link between

Q12: Consider the following statements about depreciation tax

Q14: What is a floorlet?

Q17: How many securities do you need to

Q18: Which of the following would not involve

Q42: Which of the following characteristics would best

Q55: The income calculation for a division manager's

Q56: A collection of costs to be assigned

Q73: Which of the following transfer-pricing methods can

Q82: The right (credit) side of the production-overhead