In eight years, Shu Company plans to receive $11,000 cash from the sale of a machine that has a $16,000 book value.

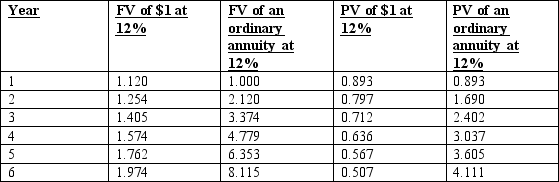

If the firm is subject to a 30% income tax rate and has a 12% after-tax hurdle rate, the correct discounted net cash flow would be:

Definitions:

Call Options

Financial contracts giving the buyer the right, but not the obligation, to buy an asset at a specified price within a specific time frame.

Underlying Asset

The financial instrument upon which derivative contracts, like options and futures, are based.

Covered Call

A combination of selling a call option together with buying the underlying asset.

Simultaneous Sale

A transaction where a selling and buying operation occurs at the same time, often used in financial strategies to mitigate risk.

Q2: When computing ∂V/∂r, what is the difference

Q3: What is a caplet?

Q5: Generally speaking, which of the following would

Q6: Calculate the MacCaulay Duration for the following

Q7: Which of the following would be the

Q11: What effect does an embedded option have

Q30: Which of the following is not an

Q69: An increasingly popular approach that integrates financial

Q79: The profit margin controllable by the segment

Q119: Valid methods exist for ranking independent investment