Racer Industries is currently purchasing Part No. 76 from an outside supplier for $80 per unit. Because of supplier reliability problems, the company is considering producing the part internally in an idle manufacturing plant. Annual volume over the next six years is expected to total 300,000 units at variable manufacturing costs of $75 per unit.

Racer must acquire $80,000 of new equipment if it reopens the plant. The equipment has a six-year service life, a $14,000 salvage value, and will be depreciated by the straight-line method. Repairs and maintenance are expected to average $5,200 per year in years 4-6, and the equipment will be sold at the end of its life.

Required:

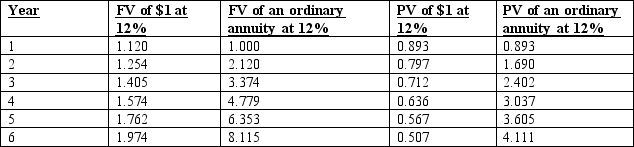

Rounding to the nearest dollar, use the net-present-value method (total-cost approach) and a 12% hurdle rate to determine whether Mark should make or buy Part No. 76. Ignore income taxes.

Definitions:

Sacrifice

The act of giving up something valued for the sake of something else regarded as more important or worthy.

Syllogistic Steps

The sequence of logical deductions in a syllogism where a conclusion is inferred from two or more premises.

Virtuous

Exhibiting virtues such as moral excellence, righteousness, and adherence to ethical principles in behavior and character.

Rude Person

An individual who behaves in a manner that is socially inappropriate, showing little respect or consideration for others.

Q1: How can you compute theta?

Q14: When pricing zero coupon bonds, are results

Q20: Using the previous discount curve price the

Q44: Flex, Inc., which is headquartered in Hoboken,

Q52: Warner Corporation is considering the acquisition of

Q66: Phyllis' Philly Steaks, a national fast-food chain,

Q73: Which of the following transfer-pricing methods can

Q81: Air Comfort manufactures air conditioning compressors in

Q89: Opportunity cost is not important in special

Q105: There is no adjustment in the payback