Marker Sail Company plans to purchase $4.5 million of equipment in the not-too-distant future. The equipment will be depreciated by the optional straight-line method over the MACRS life of 5 years. Marker is subject to a 30% income tax rate.

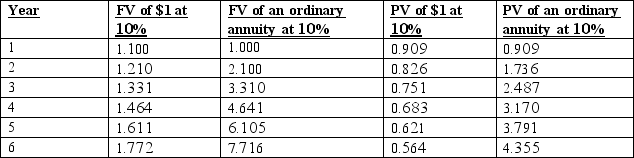

The company's accountant is about to perform a net-present-value analysis, assuming a 10% after-tax hurdle rate.

Required:

A. Determine the discounted cash flows that would be reflected in the analysis in year 0 and year 1.

B. Determine the discounted cash flow that would be reflected in the analysis in year 6, assuming that Marker sells the equipment for $450,000,

Definitions:

Therapy Process

A systematic method of treating psychological disorders and emotional difficulties, through a structured interaction between a therapist and a client.

Major Depressive Disorder

An emotional well-being issue characterized by a never-ending depressed state or lack of zest in activities, causing notable disturbances in daily habits.

Selective Serotonin Reuptake Inhibitors

A class of drugs commonly used to treat depression and anxiety disorders by increasing the levels of serotonin in the brain.

Regression Toward the Mean

A statistical phenomenon that results when unusually large or small measurements tend to be followed by measurements that are closer to the average.

Q2: What is missing from the expectations hypothesis?

Q8: What are the two important differences in

Q8: When is it assumed that the prepayment

Q11: Intuitively, is LIBOR generally higher, lower or

Q12: What is the Feynman-Kac Theorem?

Q18: Calculate the convexity of the following security:

Q30: Which of the following is not an

Q40: The City of San Diego is about

Q69: If the volume sold reacts strongly to

Q96: Darrin's Auto Northern Division is currently purchasing