The Excon Machine Tool Company is considering the addition of a computerized lathe to its equipment inventory. The initial cost of the equipment is $600,000, and the lathe is expected to have a useful life of five years and no salvage value. The cost savings and increased capacity attributable to the machine are estimated to generate increases in the firm's annual cash inflows (before considering depreciation) of $180,000. The machine will be depreciated using MACRS for tax purposes. The 5-year MACRS depreciation percentages as computed by the IRS are: Year 1 = 20.00%; Year 2 = 32.00%; Year 3 = 19.20%; Year 4 = 11.52%; Year 5 = 11.52%; Year 6 = 5.76%.

Warren is currently in the 40% income tax bracket. A 10% after-tax rate of return is desired.

Required:

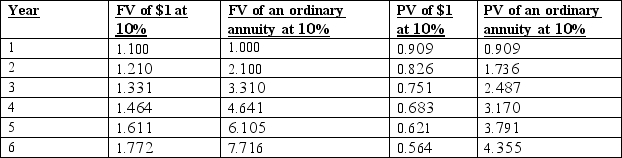

A. What is the net present value of the investment? Round to the nearest dollar.

B. Should the machine be acquired by the firm?

C. Assume that the equipment will be sold at the end of its useful life for $100,000. If the depreciation amounts are not revised, calculate the dollar impact of this change on the total net present value.

Definitions:

Personal Matter

An issue or situation that pertains exclusively to an individual's private life, often unrelated to their professional responsibilities.

Government Scrutiny

The investigation or close examination by governmental bodies into the practices, activities, and policies of individuals, organizations, or industries.

On-line Pharmacy

A platform that allows customers to order and purchase medications and health-related products over the internet.

Issues Management

The proactive process of identifying, evaluating, and dealing with issues that affect an organization, potentially becoming public controversies.

Q4: When pricing through Monte Carlo simulations on

Q5: What relation should hold across all securities,

Q5: You have two bond coupon with the

Q9: What is a solution to an Ordinary

Q13: What is a swaption?

Q80: Tyke Corporation has two divisions: Springfield and

Q86: The performance reports generated by a responsibility

Q87: The difference between absorption manufacturing cost and

Q100: The mayor of Trenton is considering the

Q108: When income taxes are considered in capital