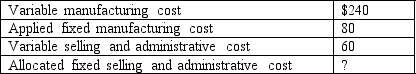

The following data pertain to Tannebaum Corporation's residential humidifier:

To achieve a target price of $450 per humidifier, the markup percentage on total unit cost is 12%.

Required:

A. Calculate the fixed selling and administrative cost allocated to each humidifier.

B. For each of the following bases, determine the appropriate percentage markup on cost that will result in a target price of $450 per humidifier: (1) variable manufacturing cost, (2) absorption manufacturing cost, and (3) total variable cost. (Round percentages to the nearest one-hundredth of a percent.)

Definitions:

Manufacturing Overhead

All indirect costs associated with the production process, excluding direct materials and direct labor costs.

Job Cost Sheet

A job cost sheet is a document that records the costs associated with a specific job or batch, tracking materials, labor, and overhead.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production, based on a particular activity base.

Machine-hours

A measure of the time that machines are operating, often used as a basis for allocating manufacturing overhead costs.

Q6: What's the intuition behind the following relationship:

Q9: What advantage does the Black-Derman-Toy model have

Q11: With respect to overhead, what is the

Q13: What is a TIPS?

Q17: From a traditional perspective, dollars of raw

Q18: How can you compute gamma?

Q50: When actual variable cost per unit equals

Q58: Activity-based-costing systems are costly, time-consuming to implement,

Q68: Consider the following statements about activity-based costing

Q112: Twilight Corporation will evaluate a potential investment