Riverview Manufacturing, Which Produces Electrical Components, Is Contemplating Submitting a Bid

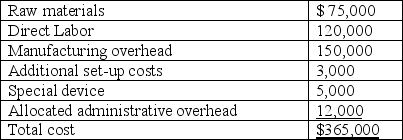

Riverview Manufacturing, which produces electrical components, is contemplating submitting a bid for 30,000 units of item no. 54. The bid's cost will be follows:

The special device will be purchased for this job and once the job is completed, the device will be discarded.

Riverview applies total manufacturing overhead of $5 to each unit (0.5 machine hours at $10 per hour). This figure is based, in part, on budgeted yearly fixed overhead of $1,440,000 and an anticipated volume of 480,000 machine hours (40,000 per month). Riverview is presently working at 85% of capacity, and the client needs the order in two months.

Required:

A. Is Riverview's current operating environment one of excess capacity or no excess capacity? Briefly explain.

B. If Riverview had excess capacity, what would be the lowest cost total that the company should use when figuring its bid for the order?

C. Can Riverview produce this order in the required time frame of two months? Explain.

D. Suppose that Riverview is in marginal financial health. Explain the benefits and problems of approaching the bidding procedure with (1) a low bid or (2) a high bid.

Definitions:

Learned Helplessness

A condition in which a person suffers from a sense of powerlessness, arising from a traumatic event or persistent failure to succeed.

Major Depressive Disorder

A psychiatric diagnosis involving an everlasting depressed mood or interest loss in actions, leading to significant life impairment on a regular basis.

Left Frontal Lobe

The region of the brain located in the left hemisphere that is involved in controlling speech, reasoning, emotions, and problem-solving.

Increased Level

A generic term indicating a higher state, amount, or degree of something compared to a previous measurement or norm.

Q1: What is the difference between flat volatility

Q1: How does the Fed reach its desired

Q7: What is a Brownian motion?

Q24: Managerial accountants use either task analysis or

Q40: Assume that the Los Angeles division increases

Q50: Which of the following project evaluation methods

Q52: Musik Corporation uses a 140% markup on

Q69: Hampton Company plans to incur $230,000 of

Q72: Drew Mellow builds custom homes in Miami.

Q73: Which of the following transfer-pricing methods can