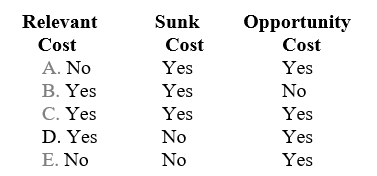

Which of the following costs should be used when choosing between two decision alternatives?

Definitions:

Issuance Price

Refers to the price at which a company's securities, such as stocks or bonds, are sold to investors when they are first made available.

Straight-line Method

A method of calculating depreciation of an asset by evenly spreading its cost over the expected useful life.

Semiannual Interest

Interest payments made twice a year on loans, bonds, or deposits.

Bond Liability

A financial obligation representing money a company owes to bondholders, to be repaid at a future date, typically with interest.

Q5: Generally speaking, which of the following would

Q11: How effective is pricing of Collateralized Mortgage

Q12: Show that, given: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6182/.jpg" alt="Show that,

Q17: Consider the following statements about the accounting

Q22: What is the most common treatment of

Q48: A budget serves as a benchmark against

Q58: The maximum amount the Cologne Division would

Q79: Depreciation is often described as a "tax

Q103: That employees make little effort to achieve

Q118: A cash flow measured in nominal dollars