Use the following information to answer the following Questions

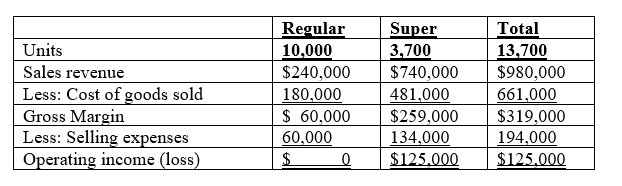

Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

-Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

Definitions:

Predetermined Overhead Rate

Predetermined Overhead Rate is a rate calculated before a period begins, used to allocate estimated overhead costs to products or job orders based on a selected activity base.

Annual Overhead Costs

Refers to the total expenses that are not directly tied to a specific product or service but are required for the business to operate, accumulated over a year.

Direct Labor Costs

The wages paid to workers who are directly involved in the production of goods or the provision of services.

Indirect Labor

Labor costs associated with support work that does not directly contribute to the manufacture of products or the provision of services, such as maintenance and supervisory wages.

Q7: A manager is more likely to investigate

Q8: Can a solution always be found in

Q46: Endotrope Corporation has an after-tax operating income

Q55: The income calculation for a division manager's

Q70: Inse Corporation uses time and material pricing.

Q76: Which of the following is used in

Q78: The direct-material quantity variance is:<br>A) $1,000F.<br>B) $1,000U.<br>C)

Q84: An advantage of the NPV method is

Q85: An unfavorable labor efficiency variance is created

Q87: The typical balanced scorecard is best described