Use the following information to answer the following Questions

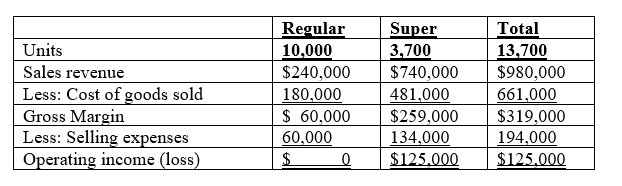

Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

-Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

Definitions:

IRR

Internal Rate of Return is a financial measure used to calculate the expected profitability of prospective investments.

NPV

Net Present Value, a method used in capital budgeting to analyze the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows.

Internal Rate of Return

A metric used in capital budgeting to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value of all cash flows zero.

Required Return

The minimum return an investor expects to achieve on an investment, considering the investment's risk level.

Q4: When pricing through Monte Carlo simulations on

Q14: Compute the spot rate duration for a

Q15: Why is it considered that implied volatility

Q18: How can you compute gamma?

Q30: A statistical control chart is best used

Q59: Davner Enterprises recently used 14,000 labor hours

Q66: Phyllis' Philly Steaks, a national fast-food chain,

Q82: The direct-labor rate variance is:<br>A) $7,800F.<br>B) $7,950F.<br>C)

Q82: The right (credit) side of the production-overhead

Q89: Opportunity cost is not important in special