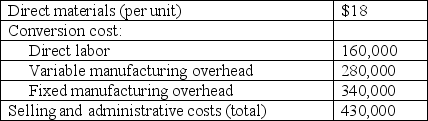

Carolina Corporation, which uses throughput costing, began operations at the start of the current year. Planned and actual production equaled 20,000 units, and sales totaled 17,500 units at $95 per unit. Cost data for the year were as follows:

Required:

A. Compute the company's total cost for the year.

B. How much of this cost would be held in year-end inventory under (1) absorption costing and (2) variable costing?

C. How much of the company's total cost for the year would appear on the period's income statement under (1) absorption costing and (2) variable costing?

Definitions:

ATC Curve

Average Total Cost Curve, a graphic representation that shows the cost per unit of output produced.

Barriers to Entry

Factors that make it difficult for new firms to enter a market, such as high startup costs, stringent regulations, or strong competition from existing firms.

Administered Prices

Prices that are set by the company rather than determined by market demand and supply conditions; often found in less competitive markets.

Cartel

An association of independent businesses or countries agreeing to coordinate their production and pricing to monopolize a market or maximize profits.

Q11: Activity-based budgeting:<br>A) begins with a forecast of

Q15: A company's sales forecast would likely consider

Q19: Match Point's variable-overhead spending variance is:<br>A) $550

Q22: In order to produce a target profit

Q57: Consider the following information:<br>Direct material purchased and

Q60: Assuming the use of activity-based costing, the

Q71: The following data relate to Department no.

Q72: Falisari Corporation has computed the following unit

Q77: Which of the following variances cannot occur

Q86: Tallequah, Inc. uses the high-low method to