Use the following information to answer the following Questions

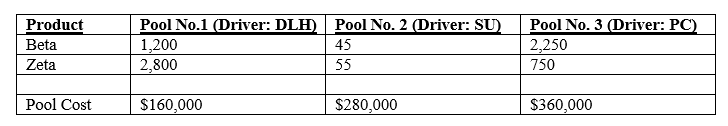

St. Vincent’s, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH) , production setups (SU) , and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow.

-The overhead cost allocated to Zeta by using activity-based costing procedures would be:

Definitions:

Treasury Stock

Shares that were issued and later reacquired by the issuing company.

Par Common Stock

The nominal or face value of common stock as stated in the corporate charter, which is the minimum amount that must be paid by investors for each share.

Preferred Stock

A type of stock that provides dividends before common stockholders and has priority over common stock in the event of liquidation.

Par Value

A nominal value assigned to a share of stock in the charter of the corporation, often used to determine legal capital.

Q2: A predetermined application rate for conversion costs

Q5: Income reported under absorption costing and variable

Q17: Using the weighted-average method of process costing,

Q19: The relevant range is that range of

Q60: Agee Company uses a process-costing system for

Q67: When goods are sold, their costs are

Q82: Two-stage cost allocation uses a first stage

Q82: The direct-labor rate variance is:<br>A) $7,800F.<br>B) $7,950F.<br>C)

Q91: Cost-volume-profit analysis is based on certain general

Q98: Grande Corporation assembles bicycles by purchasing frames,