Whitman Enterprises uses a traditional-costing system to estimate quality-control costs for its Dragon product line. Costs are estimated at 32% of direct-labor cost, and direct labor totaled $860,000 for the quarter just ended. Management is contemplating a change to activity-based costing, and has established three cost pools: incoming material inspection, in-process inspection, and final product certification. Number of parts, number of units, and number of orders have been selected as the respective cost drivers.

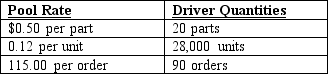

The following data show the pool rates that have been calculated by the company along with the quantity of driver units for the Dragon's:

Required:

A. Calculate the quarterly quality-control cost that is allocated to the Dragon product line under Whitman's traditional-costing system.

B. Calculate the quarterly quality-control cost that is allocated to the Dragon product line if activity-based costing is used.

C. Does the traditional approach under- or overcost the product line? By what amount?

Definitions:

Stock Investments

Investments in shares of public companies, aiming to generate income through dividends or capital gains.

Consolidation

Consolidation is the process of combining the financial statements of several subsidiaries or companies into the combined financial statements of the parent company to present as a single economic entity.

Equity Method

An accounting technique used by a company to record its investment in another company when it holds significant influence but not full control or majority ownership.

Cash Dividends

A corporation's disbursement of earnings to its shareholders as cash.

Q17: Which of the following is not an

Q31: Distinguish between least-squares regression and multiple regression

Q44: Partner Industries sells a single product for

Q46: Farmington and Associates designs relatively small sports

Q56: Variable costing of inventory and absorption costing

Q61: The accounting records of Stingray Company revealed

Q63: Assuming use of the step-down method, over

Q64: Fulton's monthly fixed fee is:<br>A) $80.<br>B) $102.<br>C)

Q81: Which of the following is an example

Q88: On the basis of this information, what