Fairchild, Inc., manufactures two products, Regular and Deluxe, and applies overhead on the basis of direct labor hours. Anticipated overhead and direct labor time for the upcoming accounting period are $1,600,000 and 25,000 hours, respectively. Information about the company's products follows.

Regular-

Estimated production volume: 3,000 units

Direct materials cost: $28 per unit

Direct labor per unit: 3 hours at $15 per hour

Deluxe-

Estimated production volume: 4,000 units

Direct materials cost: $42 per unit

Direct labor per unit: 4 hours at $15 per hour

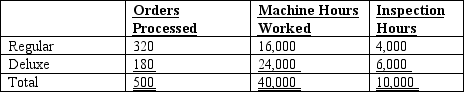

Fairchild's overhead of $1,600,000 can be identified with three major activities: order processing ($250,000), machine processing ($1,200,000), and product inspection ($150,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow.

Required:

A. Compute the pool rates that would be used for order processing, machine processing, and product inspection in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit manufacturing costs of Regular and Deluxe if the expected manufacturing volume is attained.

C. How much overhead would be applied to a unit of Regular and Deluxe if the company used traditional costing and applied overhead solely on the basis of direct labor hours? Which of the two products would be undercosted by this procedure? Overcosted?

Definitions:

Permanent Change

An alteration in a system or environment that is enduring and not reversible.

Mental Models

Internal representations of the world that people use to understand and interact with their environment.

Broad Worldviews

Wide-ranging perspectives or ways of understanding and interpreting the world and the experiences within it.

Action Learning Practices

An approach to solving real challenges through the reflective action and learning among a group, emphasizing practical interventions.

Q4: Consumption ratios are useful in determining:<br>A) the

Q6: Bratton Corporation had 6,500 units of work

Q28: California Corporation overstated the percentage of work

Q32: Corrigan, Inc. overstated the percentage of work

Q54: The following information relates to Mega Corporation:<br>*

Q62: Which of the following statements about managerial

Q64: Absorption costing is inconsistent with CVP analysis.

Q71: A formal budget program will almost always

Q71: The position of chief financial officer (CFO)

Q80: Pfitz Company is studying the impact of