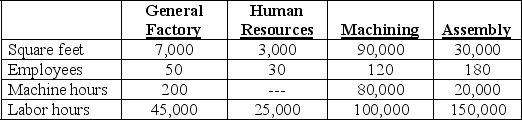

Tempest Industries has two service departments (General Factory and Human Resources) and two production departments (Machining and Assembly). The company uses the direct method of service-department cost allocation, allocating General Factory cost on the basis of square feet and Human Resources cost on the basis of employees. Budgeted allocation-base and operating data for the four departments follow.

Additional information:

· Budgeted costs of General Factory and Human Resources respectively amount to $1,560,000 and $950,000.

· The anticipated overhead costs incurred directly in the Machining and Assembly Departments respectively total $3,650,000 and $2,340,000.

· The manufacturing overhead application bases used by Tempest's production departments are: Machining, machine hours; Assembly, labor hours.

· Company policy holds that a department's overhead application rate is based on a department's own overhead plus an allocated share of service-department cost.

Required:

A. Allocate the company's service-department costs to the producing departments.

B. Compute the overhead application rates for Machining and Assembly.

Definitions:

Rule-Making Proceedings

Administrative process through which federal or state agencies create, amend, or repeal regulations, involving publication of proposed rules, public comment, and final enactment.

Human Resources

The department within an organization that deals with recruitment, management, and direction of people who work in the organization.

Internal Components

Elements or parts within a system or organization that contribute to its structure, function, or operations.

Organizations

Entities composed of individuals working together towards common objectives, characterized by structured patterns of interaction and coordination.

Q4: The capacity concept that allows for normal

Q10: Ting Corp. owns 75% of Won Corp.

Q18: When are gains on intercompany transfers of

Q26: Work-in-process inventory is composed of:<br>A) direct material

Q37: Sunk costs are irrelevant to all future

Q43: King Corp. owns 80% of Kong Corp.

Q50: Which of the following employees at Clear

Q61: In the two-stage cost allocation process, costs

Q74: Consider the following statements about the direct

Q75: Middle-level managers would likely be considered internal