Use the following information to answer the following Questions

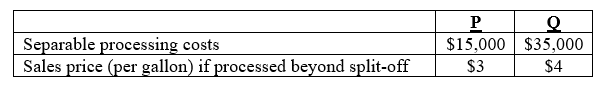

Kingston Specialty Corporation manufactures joint products P and Q. During a recent period, joint costs amounted to $80,000 in the production of 20,000 gallons of P and 60,000 gallons of Q. Kingston can sell P and Q at split-off for $2.20 per gallon and $2.60 per gallon, respectively. Alternatively, both products can be processed beyond the split-off point, as follows

-The joint cost allocated to P under the relative-sales-value method would be:

Definitions:

Reversals of Revaluation

An accounting process that negates a previously recorded increase or decrease in the value of an asset to reflect its current market value.

Accumulated Depreciation

The total amount of depreciation expense recorded for an asset over its useful life, reducing its book value on the balance sheet.

Fully Depreciated

Fully Depreciated refers to an asset that has reached the end of its useful life, and its book value is equal to its salvage value in the financial records.

Double Diminishing-Balance

A method of accelerated depreciation which charges depreciation at a higher rate in the early years of an asset's life.

Q8: Most of the Sarbanes-Oxley Act relates primarily

Q20: Green Company owes White Company money for

Q23: Errant Inc. purchased 100% of the outstanding

Q23: When are parent companies allowed to comprehensively

Q26: A business combination involves a contingent consideration.

Q31: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q35: Errant Inc. purchased 100% of the outstanding

Q39: JNG Corp has 4 segments, the details

Q59: The cost of Forrest's completed production is:<br>A)

Q100: The true statement about cost behavior is