Use this information to answer the following Questions

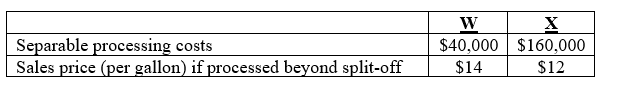

Corey Corporation manufactures joint products W and X. During a recent period, joint costs amounted to $300,000 in the production of 20,000 gallons of W and 60,000 gallons of X. Both products will be processed beyond the split-off point, giving rise to the following data:

-The joint cost allocated to W under the net-realizable-value method would be:

Definitions:

Promotional Expenditures

The amount of money a company spends on marketing and advertising activities to increase brand awareness, product visibility, and sales.

Product Demand

The quantity of a product that consumers are willing and able to purchase at various price levels.

Operations Manager

An expert tasked with managing, creating, and supervising the workflow and revamping company processes during the production of goods or services.

Q1: Using the step-down method and assuming the

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Changes from

Q18: Which of the following statements pertaining to

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $84,000. B)

Q19: How is negative goodwill treated under the

Q23: Which of the following statements is true?<br>A)

Q33: The final step in recognizing the completion

Q38: Which of the following pertaining to Consolidated

Q44: Manufacturing overhead is a pool of indirect

Q58: Under IFRS how are unrealized gains and