Clandestine Corporation allocates joint costs by using the net-realizable-value method. In the company's Texas plant, products D and E emerge from a joint process that costs $250,000. E is then processed at a cost of $220,000 into products F and

Required:

A. Allocate the $220,000 processing cost between products F and

B. From a profitability perspective, should product E be processed into products F and G? Show your calculations.

C. Assume that the net realizable value associated with E is zero. How would you allocate the joint cost of $250,000?

G.

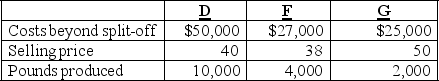

G. Data pertaining to D, F, and G follow.

Required:

Required:

Definitions:

Misinterpreting Internal Cues

Incorrectly understanding or responding to physical or emotional sensations that originate within oneself.

Anticipate Needs

The ability to predict or foresee the requirements or needs of a situation or individual before they are explicitly expressed.

Alexithymia

A personality trait characterized by difficulty in identifying, describing, and processing one's own emotional states.

Descriptive Labels

Tags or terms used to describe characteristics or aspects of objects, people, or phenomena, often simplifying complex information.

Q4: Some of the ways that JIT efficiencies

Q11: The Sarbanes-Oxley Act:<br>A) arose because of several

Q15: The main idea behind the time value

Q20: Which of the following statements about joint-cost

Q60: The role of managerial accounting information in

Q60: Agee Company uses a process-costing system for

Q79: Total costs are $180,000 when 10,000 units

Q99: As activity decreases, unit variable cost:<br>A) increases

Q113: Which type of production process is likely

Q114: Rainier Industries has Raw materials inventory on