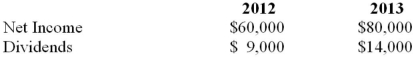

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common stock and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. Assuming that Hanson had no recorded goodwill prior to January 1, 2012, what would be the amount of goodwill appearing on Hanson' December 31, 2013 Consolidated Balance Sheet?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. Assuming that Hanson had no recorded goodwill prior to January 1, 2012, what would be the amount of goodwill appearing on Hanson' December 31, 2013 Consolidated Balance Sheet?

Definitions:

Improves Learning

Enhances the ability to acquire new knowledge or skills through study, experience, or teaching.

Stereotaxic Apparatus

A device that enables precise positioning of instruments within the brain during neurological procedures.

Brain Tissue Ablation

A surgical procedure or technique involving the removal or destruction of tissue within the brain, often used to treat neurological disorders or brain tumors.

Compensation

Following brain damage, the neuroplastic ability to modify behavior from that used prior to the damage.

Q3: The accounting records of Dixon Company revealed

Q5: When the parent forms a new subsidiary:<br>A)

Q7: The European Union has attempted to harmonize

Q9: Ting Corp. owns 75% of Won Corp.

Q9: How are realized gains from the sale

Q20: Company A has made an offer to

Q31: When preparing the consolidated balance sheet on

Q35: On the date of formation of a

Q72: The journal entry needed to record $5,000

Q98: What is the primary trade-off that an