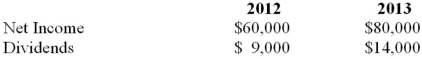

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 chapters) earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What is the amount of the acquisition differential amortization for 2012 (excluding goodwill impairment) ?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What is the amount of the acquisition differential amortization for 2012 (excluding goodwill impairment) ?

Definitions:

Type A Behavior

A personality trait characterized by high levels of competitiveness, self-imposed stress, impatience, and aggression.

Achievement Oriented

Characterized by a persistent drive to exceed standard expectations and accomplish significant goals.

Time-Pressed

The state of being under pressure to complete tasks within a limited timeframe.

Negative Emotions

Feelings that are generally considered to be unpleasant or undesirable, such as sadness, anger, fear, or jealousy.

Q17: Which of the following statements regarding the

Q18: When are gains on intercompany transfers of

Q24: Under- or overapplied manufacturing overhead at year-end

Q24: Which of the following would not be

Q38: Find Corp and has elected to use

Q47: Parent and Sub Inc. had the following

Q52: Buana Fide is a local charity which

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) All individual

Q56: The direct method ignores the fact that

Q94: Describe the types of manufacturing environments that