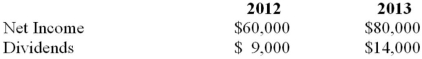

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 chapters) earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What would be the amount of the unamortized acquisition differential (excluding goodwill) at the end of 2013?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What would be the amount of the unamortized acquisition differential (excluding goodwill) at the end of 2013?

Definitions:

Needs of the Self

Essential psychological requirements necessary for an individual to maintain self-integrity, personal well-being, and development.

Cultural Outlook

The perspective and attitude towards different cultures and the ways in which cultural understanding influences an individual's views and behaviors.

Individualism

A social theory favoring freedom of action for individuals over collective or state control.

Personal Goals

Are the objectives or ambitions that an individual aims to achieve, which can be short-term or long-term.

Q5: Conversion costs are:<br>A) direct material, direct labor,

Q7: LEO Inc. acquired a 60% interest in

Q18: Broadbent Industries carries a part that is

Q22: A not-for-profit organization receives a restricted contribution

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q25: Which of the following statements is correct

Q31: If overhead is applied on the Monoco

Q36: On June 30, 2012, Parent Company sold

Q50: Which of the following statements is correct?<br>A)

Q61: Do-Good Inc. is a newly formed not-for-profit