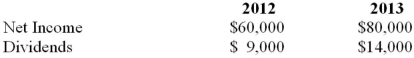

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common stock and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What effect would the purchase at January 1, 2013 have on the consolidated equity of Hanson?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What effect would the purchase at January 1, 2013 have on the consolidated equity of Hanson?

Definitions:

Unethical

Actions or behaviors that go against moral principles or professional standards.

Cultural Competency Skills

The ability to interact effectively with people of various cultural backgrounds, understanding and respecting differences to ensure effective communication and engagement.

Communication

The act of conveying information or expressing ideas to another through speech, writing, or other mediums.

Cultures

Cultures comprise the social behavior, norms, knowledge, beliefs, arts, laws, customs, capabilities, and habits of the individuals in these groups.

Q4: The capacity concept that allows for normal

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $686,700. B)

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q14: Many professions have adopted a series of

Q16: X Inc. owns 80% of Y Inc.

Q17: JNG Corp has 4 segments, the details

Q46: Company A wishes to acquire control of

Q57: If the cost of goods manufactured

Q67: When allocating service department costs, companies should

Q68: Which of the following statements is (are)